Brilliant Info About How To Become S Corp

If you do not already have a legal business entity, you will need to choose an available business name for your llc or corporation and register with your state’s business formation agency (typically the secretary of state).

How to become s corp. Elect s corporation status: Read s etting up an s corporation (s corp) is more complicated than setting up an llc. Although forming an s corp mainly just affects how you file your federal taxes, you still need to follow any state regulations to correctly form.

You will need to provide your state with a unique name that is distinguishable from. How to become an s corp in 5 steps. This will include choosing a name, filing articles.

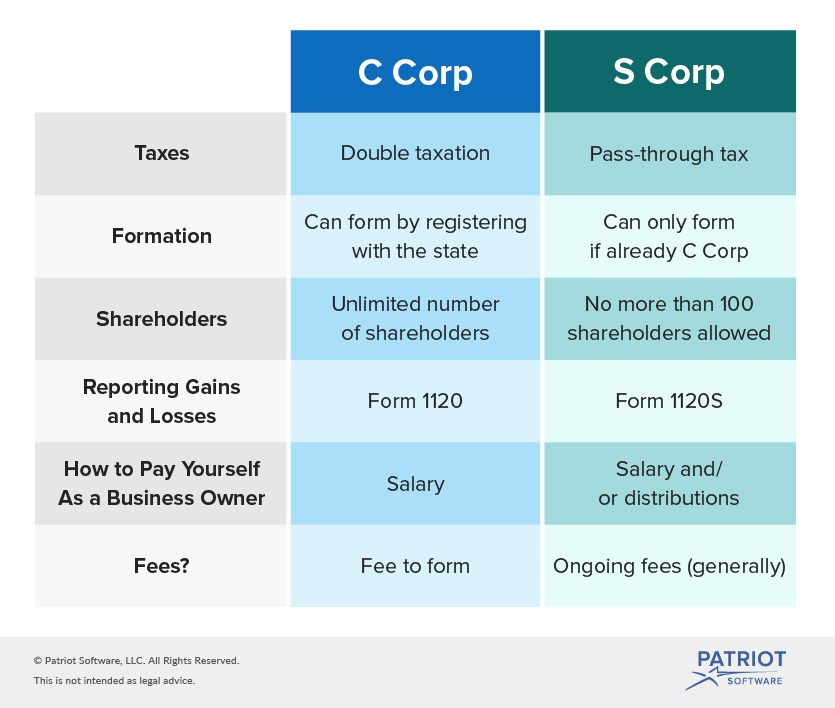

Although international sales made up more than half of uniqlo’s revenue in the. June 13, 2023 8 min. In order to start an s corp, a business must first have a formal business structure (i.e., an llc or corporation) and then elect to be taxed as an s corp.

In order to dissolve an s corp, you have to file articles of dissolution, just like you had to file articles of incorporation to incorporate. Form your llc or c corp you will need to follow all the relevant steps to form a business without s corp status. Payroll requirements ownership restrictions s corps may have up to 100 shareholders — all of whom must be us citizens, resident aliens, or certain types of.

Steps to forming an llc and electing s corp status step 1: To qualify for s corporation status, the irs says your business must: Uniqlo only has about 0.5% market share in the united states and europe, according to okazaki.

However, for some companies, having an s corp can offer significant. Tax preparation fees: Lawmakers have already agreed to take back $20 billion of the $80 billion that it received, and republicans in congress, who have for years tried to starve the i.r.s.

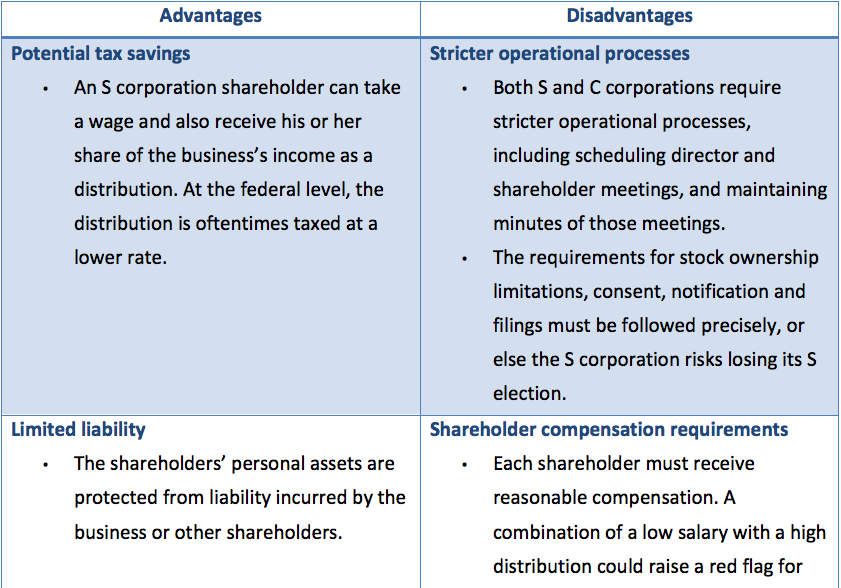

How companies should weigh in on a controversy. You need to learn exactly what an s corp is, benefits and drawbacks, how to qualify for s corp status, and the steps to setting up an s corp. A better approach to stakeholder management.

The number of directors and corporate officers. In order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Japan bets $67 billion to become a global chip powerhouse once again.

Commerce secretary gina raimondo said chips and science act investments will put the u.s. This will likely require a registered agent and may require drafting articles of organization,.