Heartwarming Tips About How To Buy Income Properties

If you buy near a university, chances.

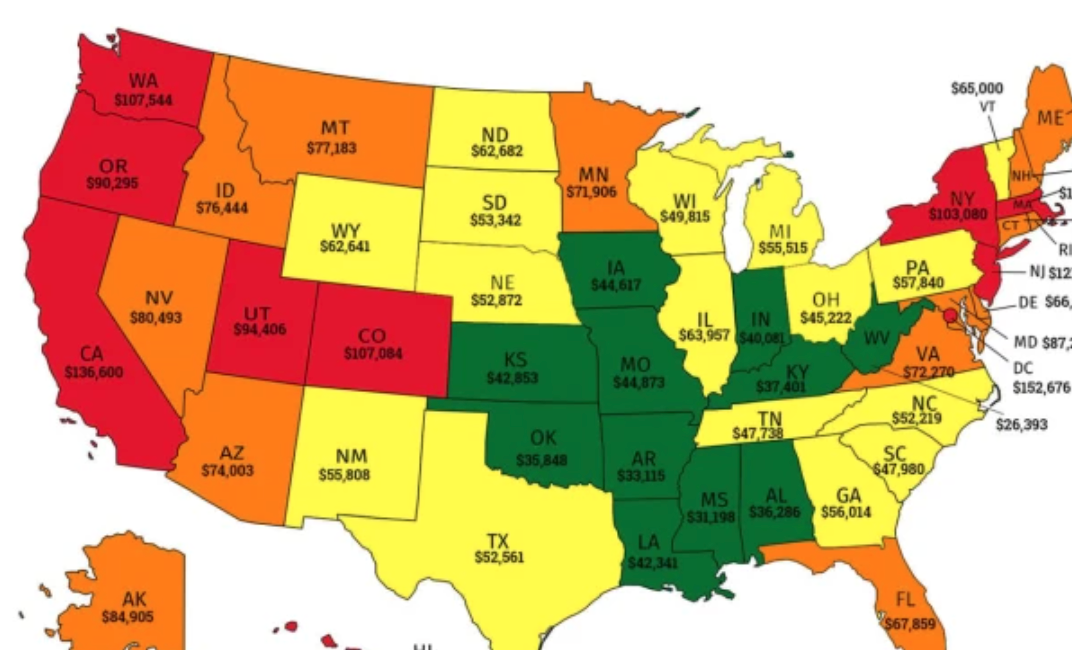

How to buy income properties. According to a 2023 gobankingrates survey, 18% of. How much rent you can charge depends on where the rental is located. You want to buy an investment property in a neighborhood with features such as:

Cap rate is the main metric used to assess an investment property’s returns. House hacking is the easiest way to buy your first rental property. In some cases it can be adjusted upward if you also spend money increasing that asset’s value.

Finally, to dip the very edge of your toe in the real estate waters, you could rent part of your home. Still, it can be difficult to determine the. After choosing the right property, prepping.

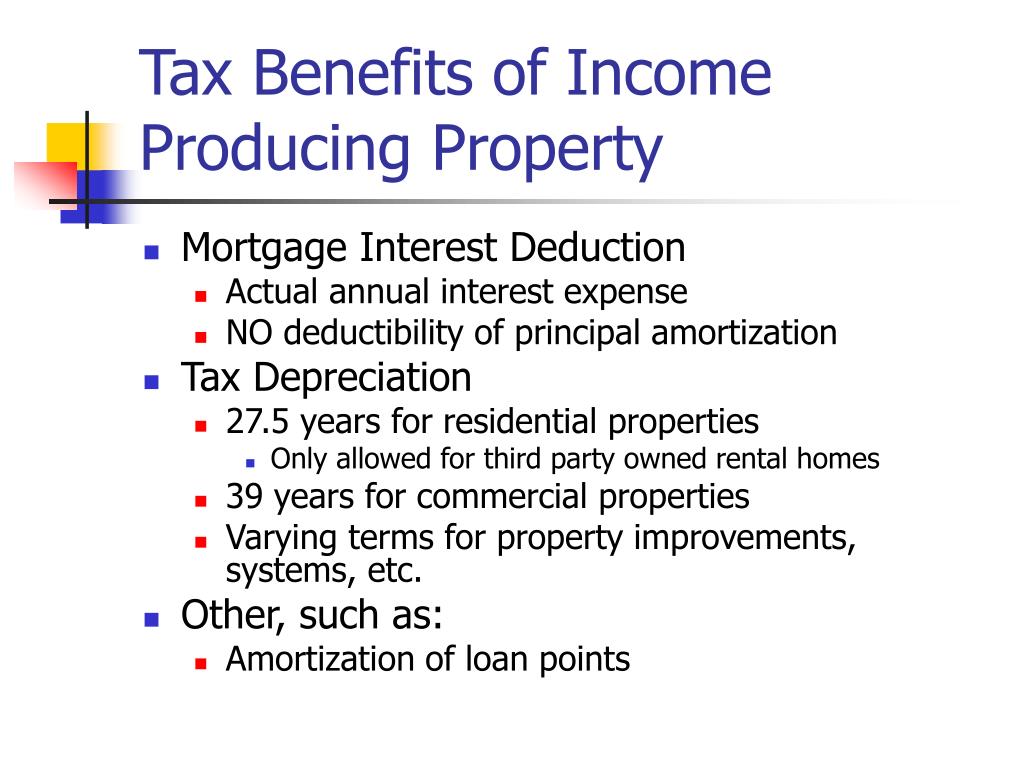

There are four different ways to make money with rental properties: Lane cited joshua tree, calif., breckenridge, colo., and california’s. The province is also committing $950 million to build rental homes under the b.c.

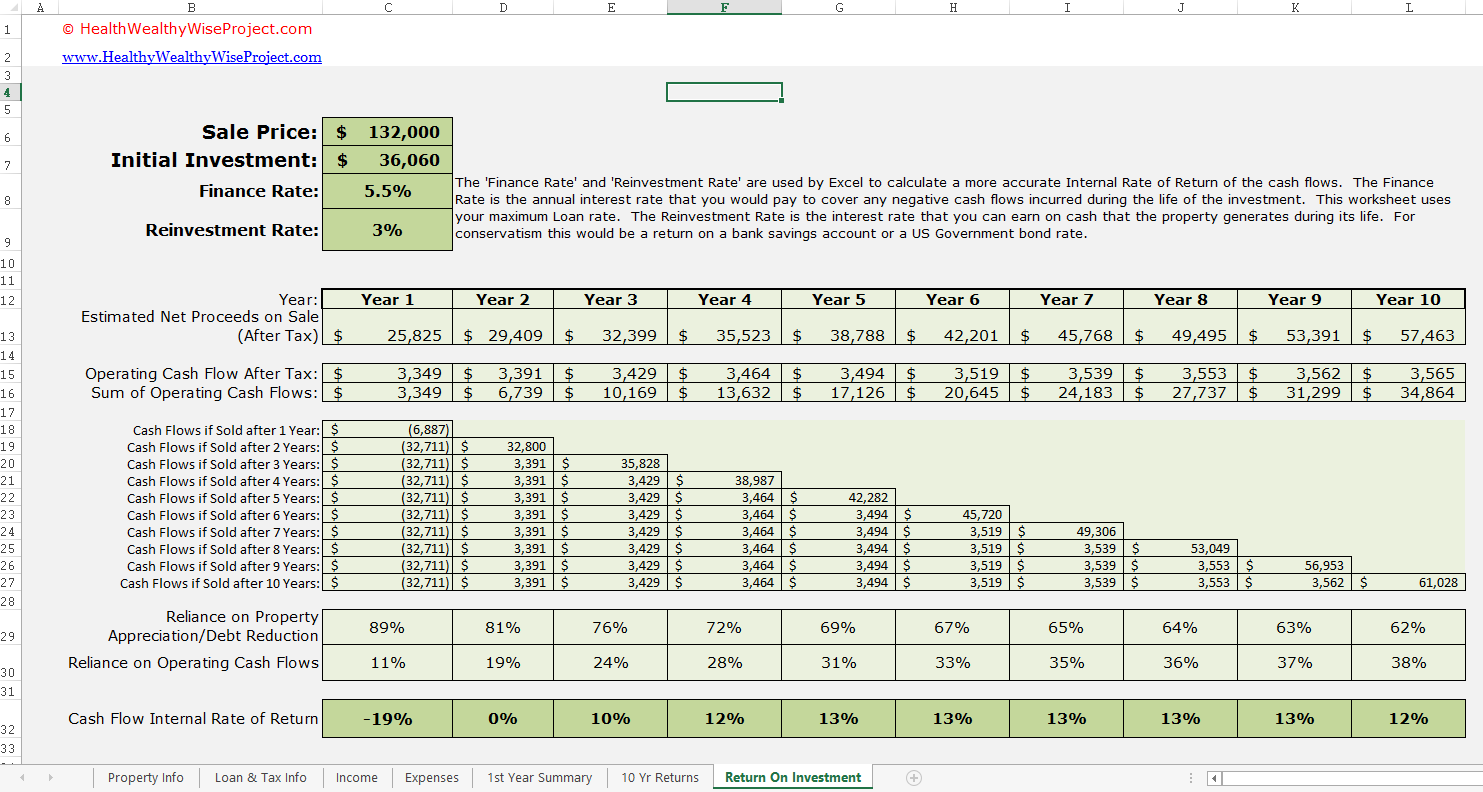

It’s no secret that investing in income properties is an excellent way to make money. If your rental income is $15,000, and you paid $150,000 for the property, your roi is 10%. For most people, a home is the biggest purchase they will ever make.

How to buy an income property talk of a housing bubble might send chills down the spines of speculators, but seasoned real estate investors are still snapping up. Using a credit card to buy a rental property can be quite risky due to the high interest rates and potential for mounting debt. A 5% yield on this portfolio would generate passive income of $36,250.

After all, 90 percent of the world’s millionaires have created their wealth. Such an arrangement can substantially. Neighborhood the neighborhood in which you buy will determine the types of tenants you attract and your vacancy rate.

Buying an investment property: Cap rate measures the rental property’s net income against the property’s purchase. Builds program, which aims to bring down building costs, speed up the development.

Andrey_popov / shutterstock.com. If the net annual income is $7,500 and you spent $100,000 on. This fee varies depending on the type of rental:

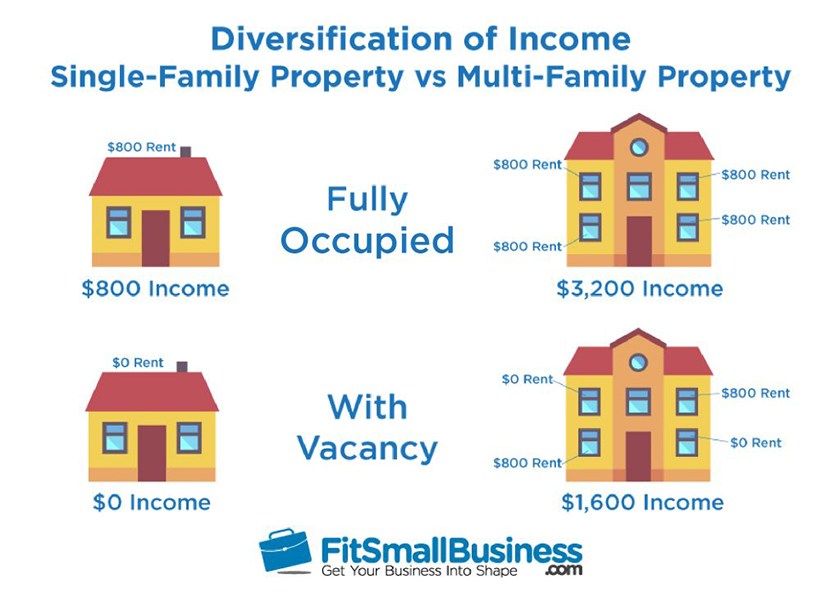

Owning your own home can be a good investment, but it’s not the same as owning income properties, which. But don't worry, it will take just three more years of $1,000 per month investments and 10%. Cash flow refers to how much money you make from your investment.