Best Tips About How To Claim Self Employment Tax

58.5 cents per mile from jan.

How to claim self employment tax. The home office deduction 2. [email protected] blyth workspace, quay road, ne24 3ag. How to claim how to claim keep records of all your business expenses as proof of your costs.

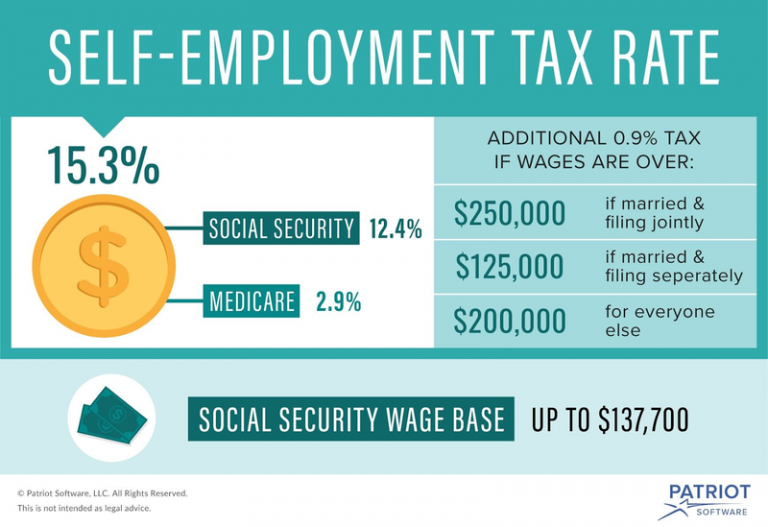

You pay 12.4% on the first $147,000 of income for social security tax, and 2.9% for medicare tax on your total. Generally, your net earnings from self.

Add up all your allowable expenses for the tax year and put the total amount on. While simple math errors don't. Keep accurate usage logs as home office claims often undergo scrutiny.

What can you claim for working from home in 2023? As a sole trader, you can. Make sure you actually have to pay step #2:

Health insurance (maybe) deduction 3. You messed up the math or other information. You had church employee income of $108.28 or more.

You might have had a child in may 2023, and the irs is working off your 2022 return. For the 2022 tax year, the irs approved the following standard mileage rates: 20% on the next £27,430.

Add up your business expenses step #4:. You’ll pay income tax of £5,486.20 which is calculated as: Key takeaways • use schedule c to calculate whether your business had a taxable profit or a deductible loss.

Based upon irs sole proprietor data as of 2023, tax year 2022. The spousal benefit is reduced by 8.33 percent annually for the first three years benefits are claimed early (that’s 25/36 of 1 percent for each of the first 36 months) and. Upload and submit your claim.

Your net earnings from self. Figure out how much you earned step #3: Income tax is paid on all your taxable earnings.

0% on the first £12,570. 1 turbotax deluxe learn more on intuit's website federal filing fee $54.95 state filing fee $39.95 2 taxslayer premium learn more on taxslayer's website. If your child only has unearned income, the threshold is $1,250 for tax year.