Build A Info About How To Quickly Raise Your Credit Score

Achieving good credit can take years but there are a few steps you can take to give your score a boost.

How to quickly raise your credit score. For better or worse, credit checks are a fact of life. When calling your issuer, tell the customer service representative you’d like to request a credit limit increase on your card. Of the three credit bureaus, experian offers the best user experience.

Register on the electoral roll. Find out when your issuer reports payment history. Experian can help raise your fico® score based on bill payment like your phone, utilities and popular streaming services.

Being on the electoral roll gives lenders proof that you are who you. There’s a premium membership for $24.99 monthly that adds benefits like a credit score. How to help raise your credit score.

Find out how fast and how influential each strategy is on your credit. The representative should review the. Find out what your credit score is.

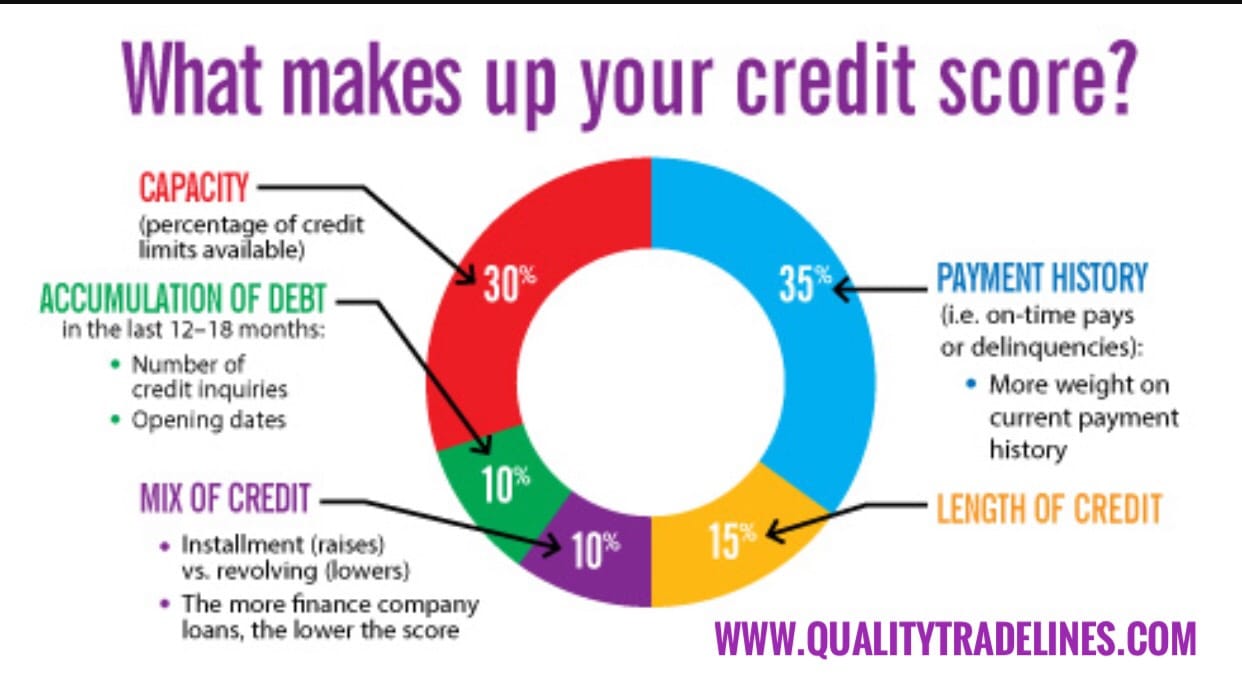

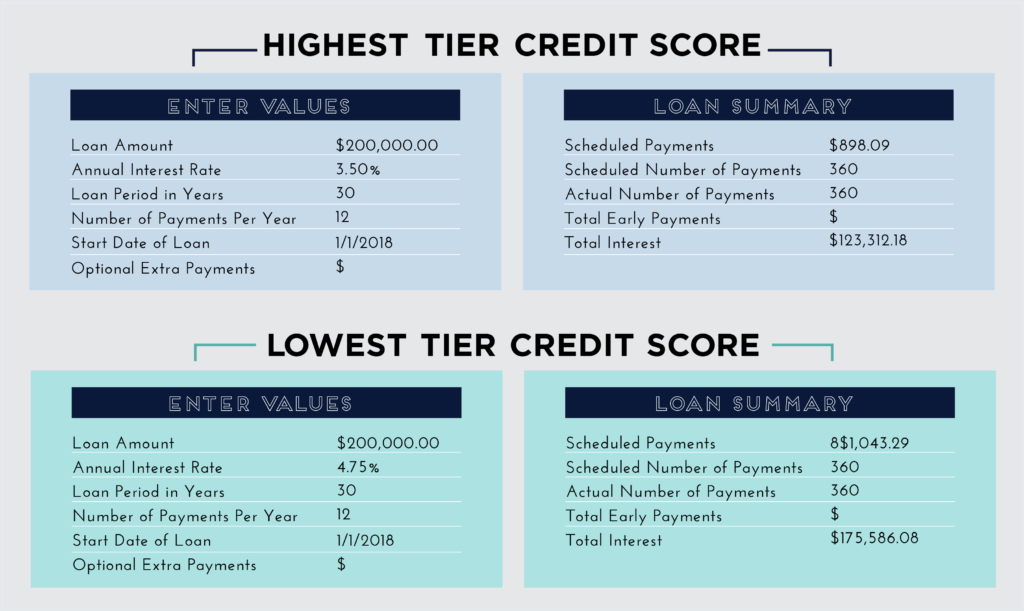

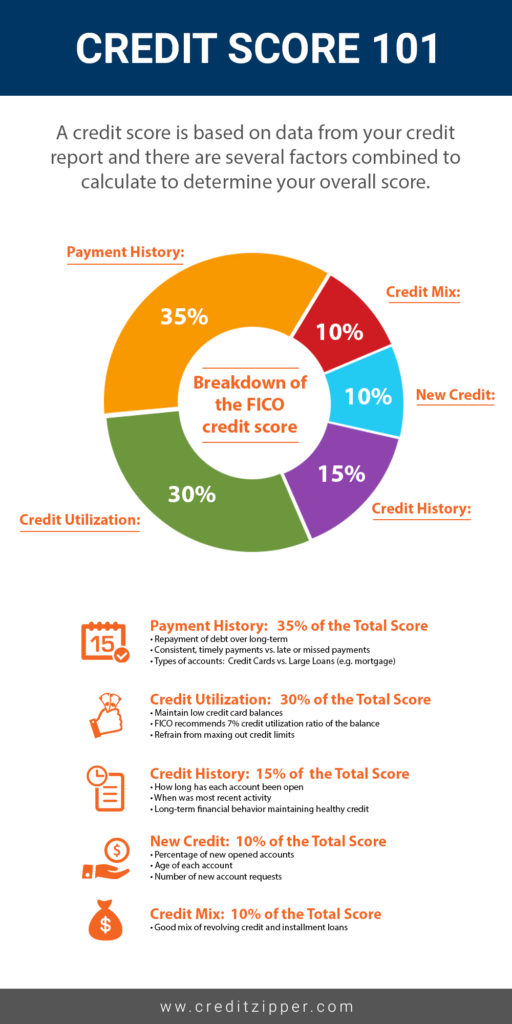

How to raise your credit score fast. While credit scores tend to involve more complex financial risk models, it’s fairly simple to make small adjustments to get. 2) amount of money you owe versus your total available credit.

How to improve your credit score quickly. Depending on your individual situation, there may be ways to raise your scores quickly — like paying down all your debt in a very short span of time. Top tips to boost your creditworthiness.

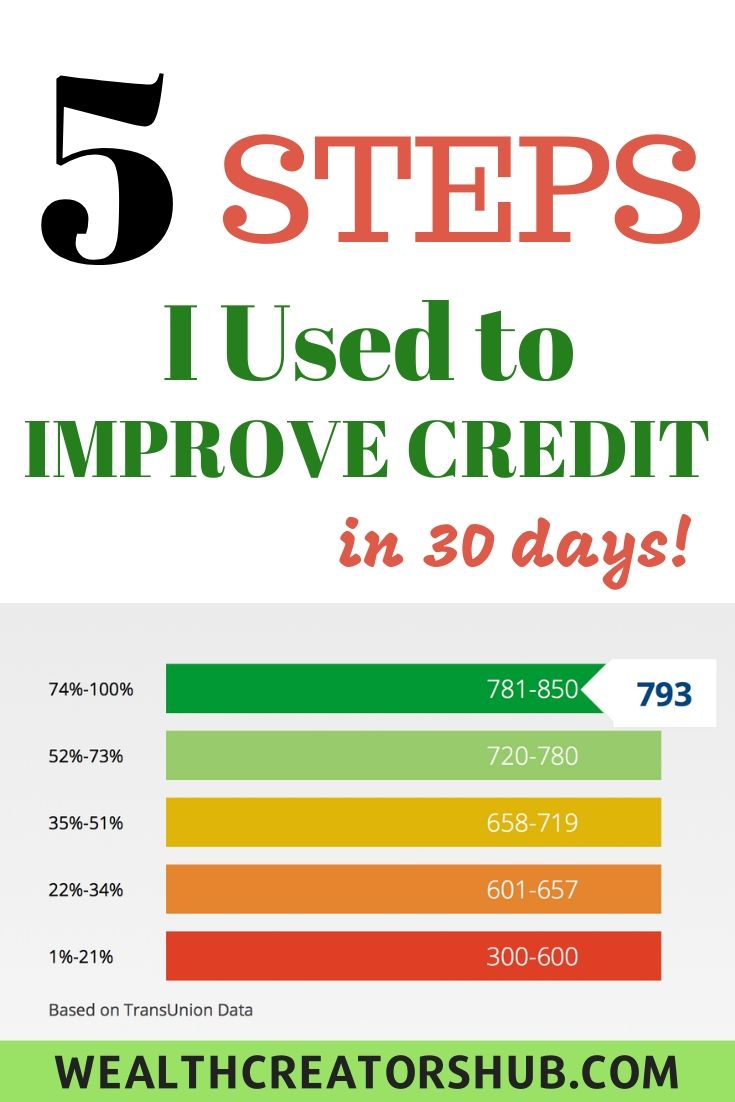

3) length of credit history. The major contributing factor to improving my credit score in just 30 days was decreasing my credit utilization ratio. Here are 9 effective methods to improve your credit score fast:

1) payment history of credit cards and loans. One of the most important factors affecting your score is your payment history. Pay your bills on time.

This is possibly the easiest way to help build your credit rating. Learn nine ways to boost your credit score by up to 100 points in a short time, such as paying down balances, asking for higher limits, and disputing errors. Strategic payment of credit card balances.

These won’t work for everyone because many solve specific. If you’re wondering how to raise your credit score, start with these steps: Everyone should take time to manage their credit report and.

![7 Tips to Increase Your Credit Score [Infographic]](http://www.trimurty.com/blog/wp-content/uploads/2016/12/Infographic-7-01-1.jpg)